CALENDAR FOR SPECIAL TAXPAYERS (SPE) AND WITHHOLDING AGENTS FOR THOSE OBLIGATIONS THAT MUST BE FULFILLED IN 2026 AND FOR THE PAYMENT OF THE SPECIAL CONTRIBUTION FOR THE PROTECTION OF PENSIONS TO BE FULFILLED IN 2026

In Official Gazette No. 43,273 of December 2, 2025, Administrative Ruling No. SNAT/2025/000091 (the Ruling) by the National Integrated Service of Customs and Tax Administration (SENIAT), through which it establishes the calendar of special taxpayers and withholding agents for those obligations that must be fulfilled in the year 2026. The Order establishes the following:

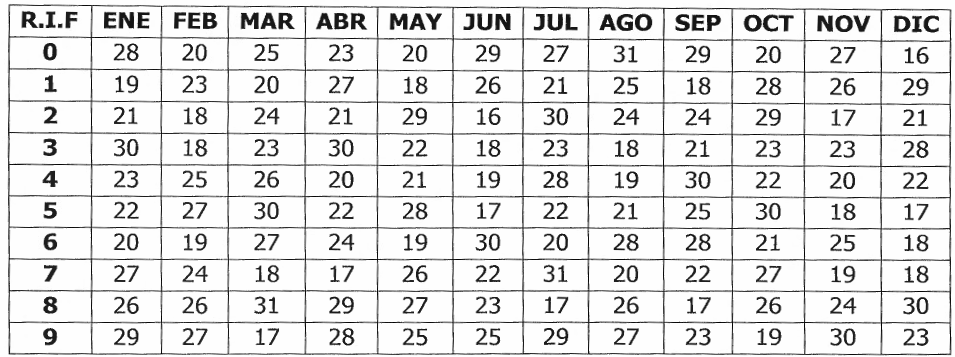

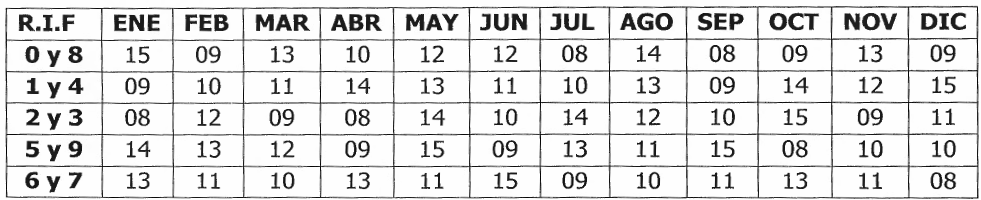

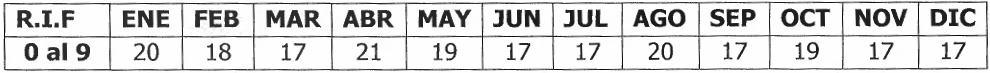

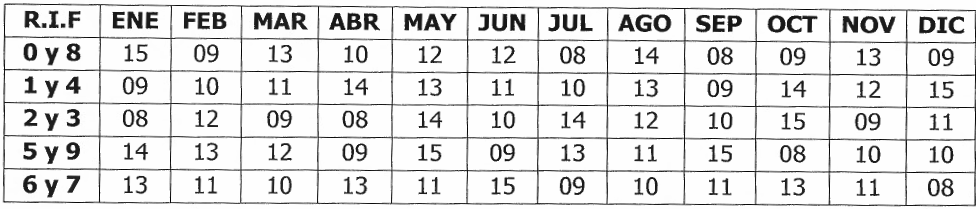

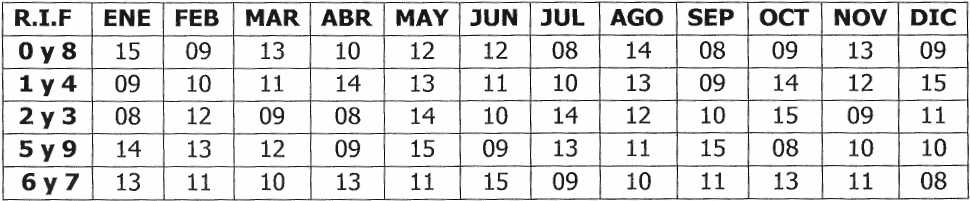

Special Taxpayers expressly notified of this condition by SENIAT, must file the returns and make the respective payments of the taxes indicated below, according to the last digit of the number of their Single Tax Information Registry (RIF) and on the expiration dates of the calendar for the year 2026 established as follows:

a. VAT, ISLR advances, IGTF, and VAT withholdings.

a. Between the 1st and 15th of each month, both inclusive:

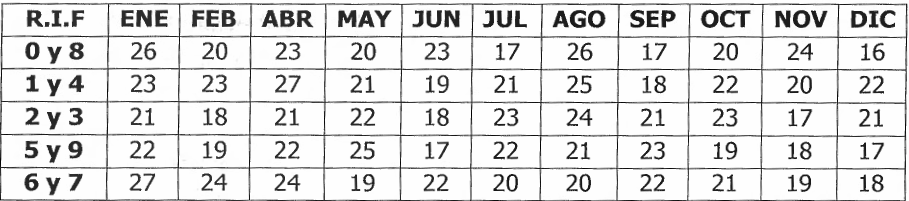

b. Between the 16th and the last day of each month, both inclusive:

b. Income Tax Estimates (ISLR) (declaration and payment of portions of regular and irregular fiscal years:

c. ISLR withholdings:

d. Gambling activities:

e. Withholdings of ISLR lottery prizes:

– Between the 1st and 15th of each month, both inclusive:

– Between the 16th and the last day of each month, both inclusive:

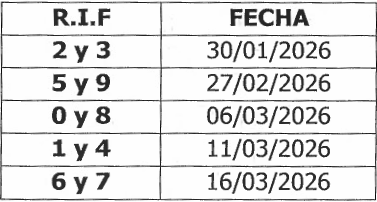

f. Annual ISLR self-assessment (financial year from 01/01/2025 to 31/12/2025):

g. Annual self-assessment of the ISLR for irregular years:

h. Tax on large estates:

i. Declarations contribution of 70% of the income of the disconcerted services or autonomous services and decentralized entities:

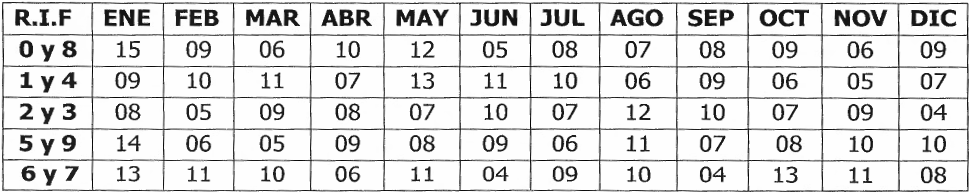

j. The declarations of the Special Taxpayers expressly notified of this condition by SENIAT, who are engaged in mining or hydrocarbon and related activities, such as refining and transportation, and are not recipients of royalties derived from such exploitations; they must file the returns and make the respective payments of the value added tax monthly, according to the last digit of the RIF, on the due dates of the calendar for the year 2026 that are established below:

Special taxpayers with exempt or exempt activities must file a quarterly VAT informative return, generating ISLR advances.

The Annual Self-Assessment of the ISLR and the additional portions for special taxpayers (20 and 40 days after the due date) are regulated.

Mining and hydrocarbon activities must submit an estimated declaration in the first 45 days after the end of the financial year.

Special subjects that do not carry out mining or hydrocarbon activities must declare and pay ISLR and VAT advances according to the schedule established in Article 1 of the Providence.

Failure to comply with the provisions of the Ruling will be sanctioned in accordance with the Organic Tax Code

This Order shall enter into force as of the date of its publication in the Official Gazette of the Republic of Venezuela

***

In Official Gazette no. 43,273 dated December 2, 2025, Administrative Ruling no. SNAT/2025/000092 (the Ruling) by the National Integrated Service of Customs and Tax Administration (SENIAT), through which it establishes the calendar for the declaration and payment of the special contribution for the protection of social security pensions against the imperialist blockade to be fulfilled in the year 2026 (LPP). The Order establishes the following:

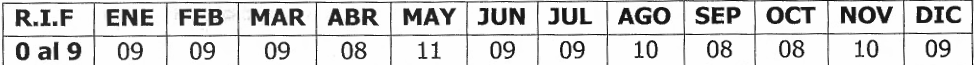

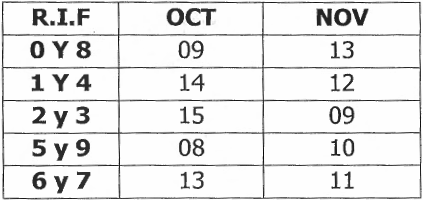

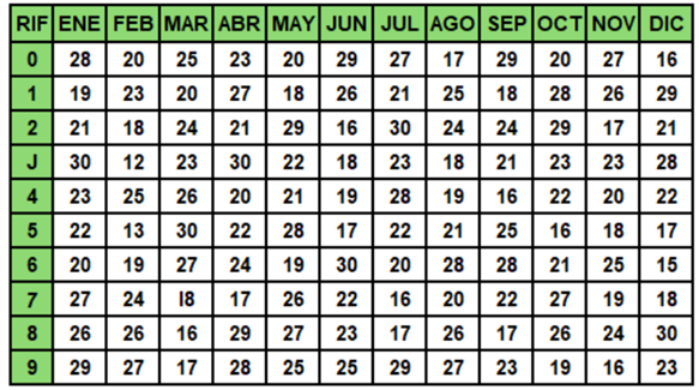

Legal persons, as well as any other partnerships of persons, including irregular or de facto companies, of a private nature, domiciled or not in the Bolivarian Republic of Venezuela, which carry out economic activities in the national territory, must declare and pay the special contribution for payments made to workers for wages and bonuses of a non-salary nature. destined to contribute to the special protection of the social security pensions of the Venezuelan people, according to the last digit of the Single Registry of Fiscal Information (RIF), on the dates of the calendar established below:

In the event of payment of salaries and bonuses of a non-salary nature in a currency other than that of legal tender in the country, these amounts must be converted into bolivars, using the official exchange rate dictated by the Central Bank of Venezuela that is in force at the time of payment of the labor remuneration. to determine the basis for calculating the special contribution provided for in the LPP.

Failure to comply with the obligations established in the Ruling shall be sanctioned in accordance with the provisions of the Constituent Decree by which the Organic Tax Code is issued and in the LPP.

The Ruling shall enter into force as of the date of its publication in the Official Gazette of the Bolivarian Republic of Venezuela.

Contacts:

LEĜA Abogados

infolaw@lega.law

+58 (212) 277.22.00

www.lega.law

Luis Cardona

lcardona@lega.law

+58 (414) 311.38.18

Jesus Castillo

jcastillo@lega.law

+58 (424) 212.05.26

The objective of LEĜA Informa is to provide information to the clients and related members of LEĜA Abogados. The information contained in this report is for informational purposes only and is not intended to provide legal advice. Readers should not act on the basis of the information contained in this report without first obtaining specific legal advice. The LEĜA Informa may be reproduced and shared in whole or in part, always indicating the authorship of LEĜA Abogados.

©2022 LEĜA Abogados.